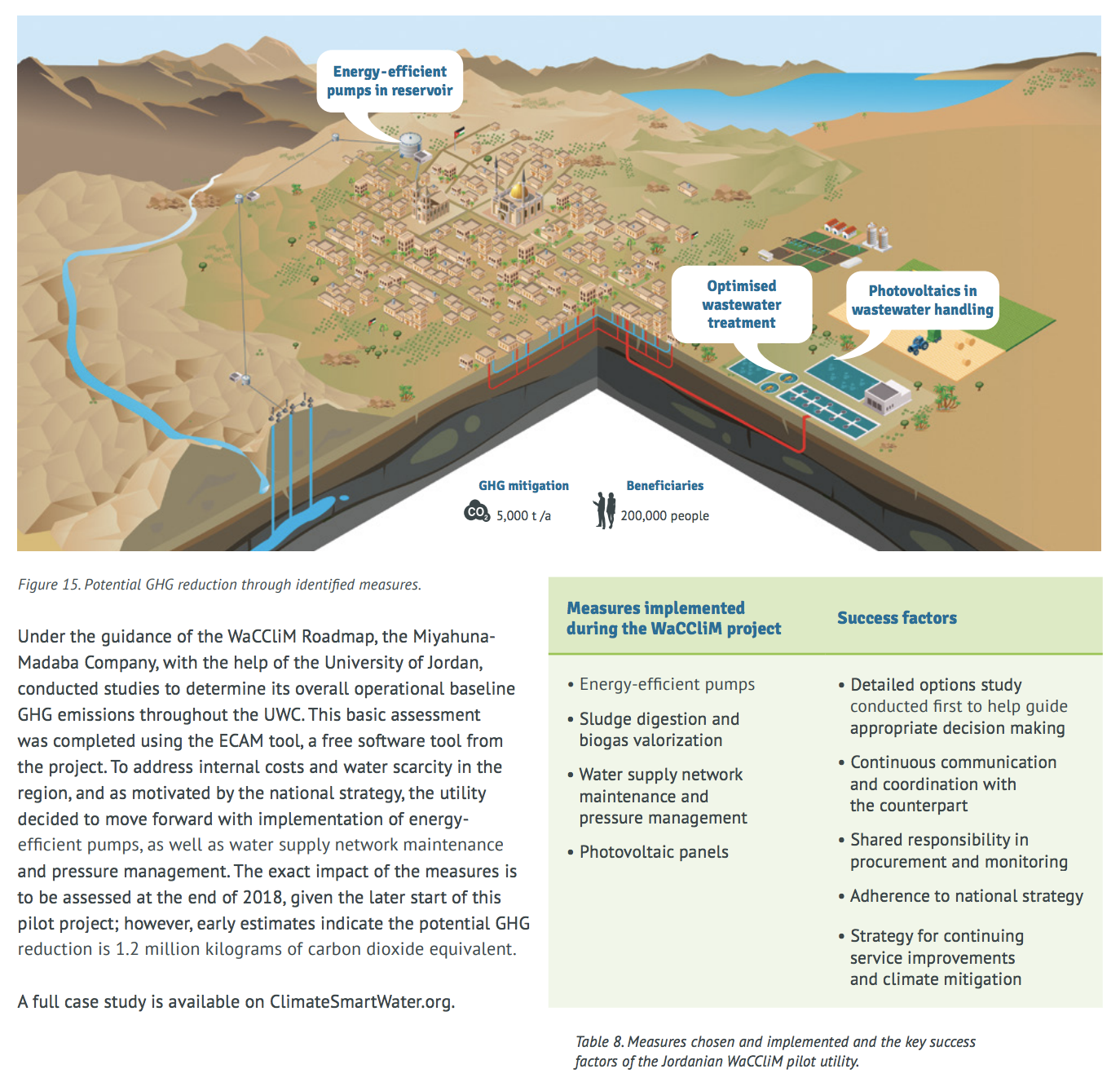

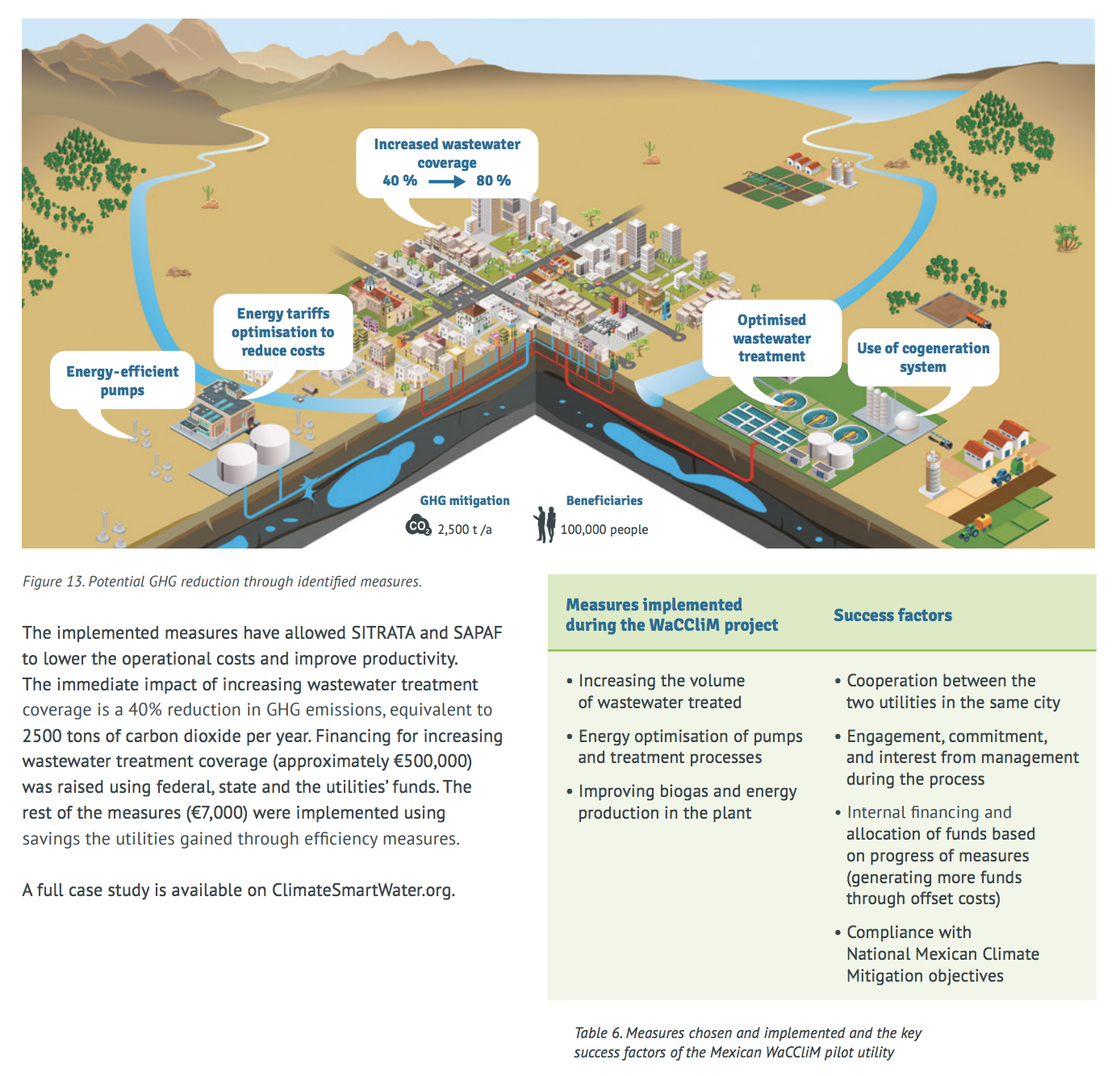

Implement measures: setting plans into motion

After using the ECAM tool to assess your system, areas of improvement and suitable solutions will emerge with good potential to reduce energy cost and/or greenhouse gas emissions (GHG). Here are a few steps to move towards implementation: